Benefits Of Investing In Dividend Stocks

Additionally, the commitment to providing cash to its investors can prevent unnecessary spending on the company side. In fact, there can be significant positives to investing in stocks without dividends.

dividend stock portfolio Dividend stocks, Stock

Stocks do not demand a lump sum investment amount.

Benefits of investing in dividend stocks. Have you seriously considered a dividend investing strategy? Dividend stocks are stocks issued by companies who redistribute a portion of their profits to their shareholders on a regular basis. Add dividend stocks to your investments to provide essential diversification.

Understanding the pros and cons of dividend investing (basics): There are several steps involved in the dividend stock investing process: And, knowledge about how to construct a dividend portfolio.

Here are a few benefits that come with investing in dividend stocks. Here, the investors enjoy the benefits of dividend income along with capital appreciation. According to hartford funds, from december 1960 to december 2018, 82% of the total return of the s&p 500 index (which comprises 500 large companies.

Anyways, if you are new to dividend investing, let me give you a brief introduction. Benefits of dividend investing 1. Not every stock pays dividends, the most popular dividend stocks, however, are the ones that do pay out.

This means that, over time, their share prices are likely to appreciate in value. Keep reading this article to see 3 downsides to dividend investing. You might consider the dividend aristocrats as best in show in terms of the dividend growth stocks out there.

A dividend is an additional income for investors, which is paid annually by most companies. To ease you in with dividend investing, you should start with looking into the available dividend lists such as dividend aristocrats, dividend achievers, and the dividend ambassadors. Dividend stocks provide cash to shareholders, which can be a good source of passive income for many investors.

The market has been absorbing many ipos in 2020 (550 to date), causing some market turbulence. Dividends have other benefits besides providing income during retirement. Based on the investment benefits from dividend investing outlined below, i have established my 7 dividend investing rules to be successful.

A $50 stock, if it's tied to a growing company, will eventually be a $60 stock, an $80 stock, and a $100 stock. Cons of finding dividend stocks. Most investors like dividend stocks because of the fact that they can provide a steady source of income with little or no work, much like interest from a bank account but with a greater potential for return on investment.

Those stocks paying you dividend income will also be increasing in value over time. Dividend growth investing offers investors a lot of benefits that can complement growth stocks in your portfolio. Companies that don’t pay dividends on stocks are typically reinvesting the money that might otherwise go to dividend payments into the expansion and overall growth of the company.

Purchasing dividend stocks is a popular strategy for many investors. Another feature of directly investing in stocks is that you can buy at your own discretion there is no compulsion of investing a particular sum of amount every month. The total amount of dividends paid out to shareholders relative to the net income of the company is referred to as the payout ratio.

They add to total return, especially when you reinvest the dividends to buy more shares. Sections like getting started with dividend stocks may help you avoid the pitfalls some investors make when they begin investing for dividends. First of all, the dividend investor must know how to find and identify dividends stocks.

Specifically, a successful dividend investor must be able to execute their dividend investing strategy on 4 levels. Research quality stocks with low volatility. One of the most popular ways to generate income from stocks is dividend investing.

Steady income stream the biggest advantage of buying One downside to investing in stocks for the dividend is an eventual cap on returns. Below, we are going to walk you through some of the main benefits of investing in these dividend aristocrats so that you can gain a better understanding of why they might be a good addition to your investment portfolio.

Dividend investing is investing in stocks that pay a dividend. 3 benefits of dividend stock investing. The first is to use a stock screener provided by your broker.

BlueChip Stock Investment Benefits Of Dividend Paying

The Rewards of Investing in Quality Dividend Companies

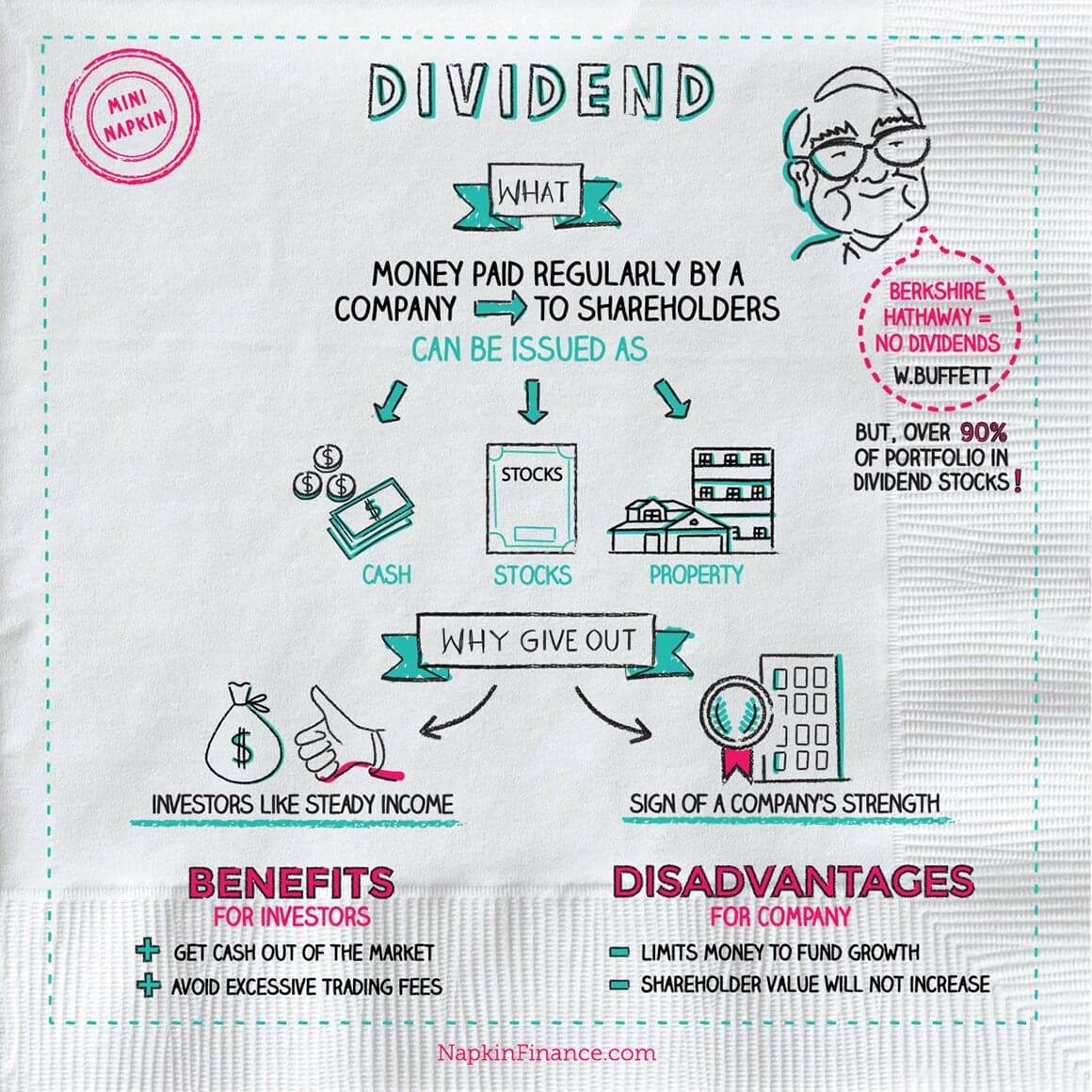

Dividend Explained Chart in 2020

Investing Ideas on Instagram “Just giving some ideas here

BENEFITS OF A ROTH IRA in 2021 Roth ira, Investing

Benefits of investment Mutuals funds, Investing

Dividend Stocks vs Growth Stocks Know the Differences! in

Benefits and Disadvantages of Equity Shares Investment

Dividend Aristocrats ETF Pick ProShares S&P 500 Dividend

672 Likes, 76 Comments Entrepreneur•Business•Success

3 Dividend Stocks to Make Your Retirement Sweeter The

Marketing Solutions on Twitter Social security benefits

Home Care for Seniors Does it cost less than assisted

What are High Dividend Mutual Funds? Mutuals funds

Post a Comment for "Benefits Of Investing In Dividend Stocks"